inheritance tax waiver indiana

2 Ohio does not require a waiver if the transfer is to a surviving spouse and the value of the estate is less than 25000. For individuals dying after Dec.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Contact an Indianapolis Estate Planning Attorney For more information please join us for an upcoming FREE seminar.

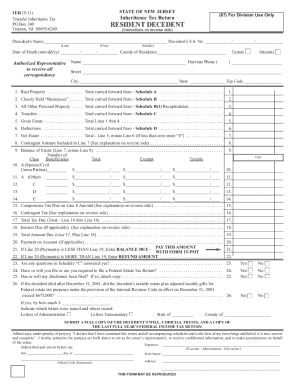

. Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012. The Inheritance tax was repealed. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed and no tax has to be paid. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Indiana inheritance and gift tax.

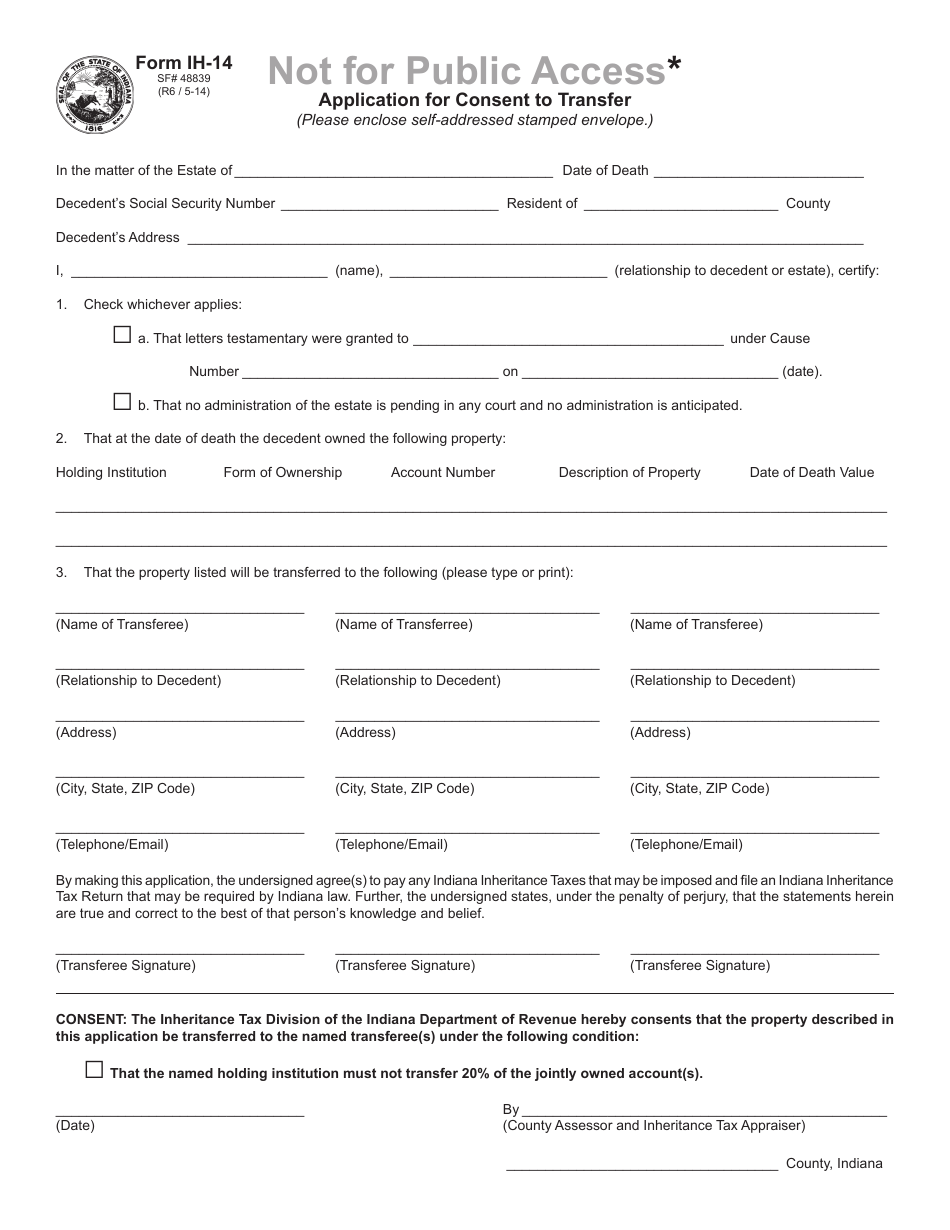

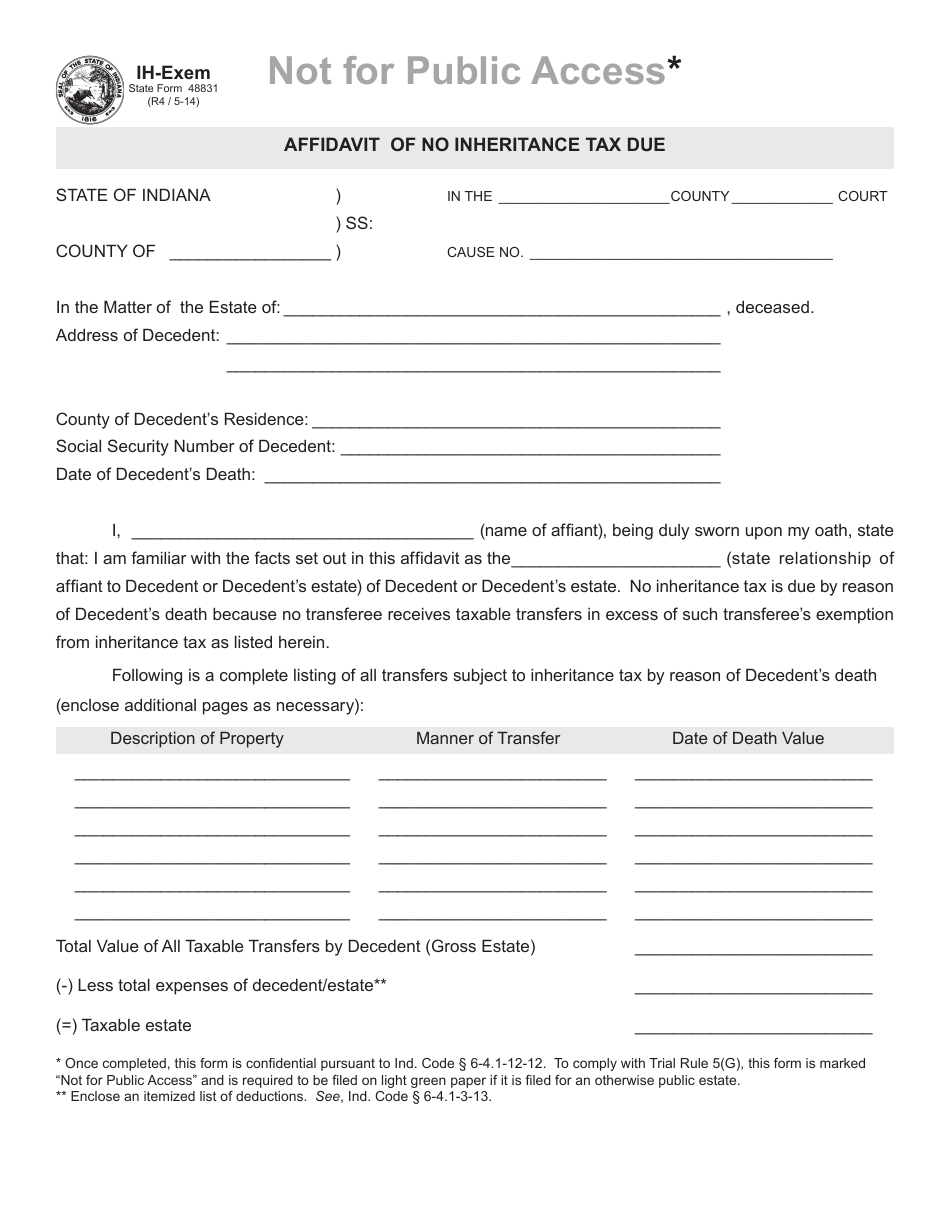

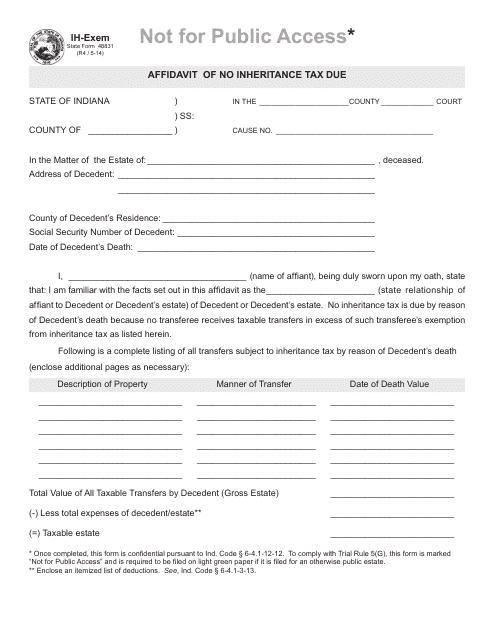

In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account Form IH-19 are required for those dying after Dec. Use of Affidavit of No Inheritance Tax Due This form does not need to be completed for those individuals dying after Dec. Those seeking to transfer decedents financial assets will need to complete and submit a Consent to Transfer Form IH-14.

There is also a tax called the inheritance tax. Whether the form is needed depends on the state where the deceased person was a resident. Do not file Form IH-6 with an Indiana court having probate jurisdiction.

Business or occupation 3. Inheritance tax applies to assets after they are passed on to a persons heirs. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012.

Its the job of the personal representative the executor named in the will to file the inheritance tax return if one is required. Payment The resident inheritance tax is to be paid to the Indiana Department of Revenue PO. Indiana Affidavit Forms - Indiana Inheritance Tax Waiver Form.

Box 71 Indianapolis IN 46206-0071. Idaho no estate tax or inheritance tax illinois the top estate tax rate is 16 percent exemption threshold 4 million indiana no estate tax or inheritance tax. Box 71 Indianapolis IN 46206-0071.

Indiana repealed the inheritance tax in 2013. 205 2013 Indianas inheritance tax was repealed. Washington doesnt have an inheritance tax or state income tax but it does have an estate tax.

2 Bring Your Paperwork Online - 100 Free. In addition no Consents to Transfer Form IH-. For individuals dying after December 31 2012.

Get Started Today - 100 Free. 1 2013 this form may need to be completed. There is no inheritance tax in Indiana either.

Date of death 4. Some financial institutions call this form a tax waiver Indianas form is the Consent to Transfer form Form IH-14. According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island and Tennessee.

An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. This form is prescribed under Ind. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas and Wyoming.

Inheritance tax was repealed for individuals dying after Dec. We offer thousands of affidavit forms. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. No tax has to be paid. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

Repeal of Inheritance Tax PL. Decedents residence domicile at time of death 5. Payments made within 9 months of decedents date of death receive a 5 discount.

Social Security number 6. Payment The nonresident inheritance tax must be paid to the Indiana Department of Revenue PO. 31 2012 no inheritance tax has to be paid.

Box 71 Indianapolis IN 46206-0071. Just one return is filed even if several inheritors owe inheritance tax. When do you need an estate tax waiver in Indiana.

A legal document is drawn and signed by the heir waiving rights to. Select popular General Affidavit Heirship Affidavit Small Estate Affidavit Death of Joint Tenant Affidavit Lost Note affidavit Affidavit of Domicile and others. It may be used to state that no inheritance tax is due as.

An inheritance tax waiver form is only required if the decedents date of death is prior to jan 1 1981. Indiana Inheritance and Gift Tax. Please read carefully the general instructions before preparing this return.

For example Indiana requires a waiver if the deceased person was a resident of the state unless the estate is being transferred to a surviving spouse. 1 Create Print A Legal Waiver. Unavoidable delay the tax cannot be determined within 12 months the department may reduce the interest rate to 6.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. However other states inheritance laws may apply to you if someone living. The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO.

States With No Income Tax Or Estate Tax The states with this powerful tax combination of no state estate tax and no income tax are. Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax. In 2012 the Indiana legislature voted to abolish the states inheritance tax.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. That process outlined in Indiana Senate Bill 923 will take ten years completely eliminating the tax in 2022. For those individuals dying before Jan.

Ad Easily Create A Legal Waiver For Immediate Use. The County Assessors Office will review the forms submitted and if everything is in order grant their consent to transfer the asset.

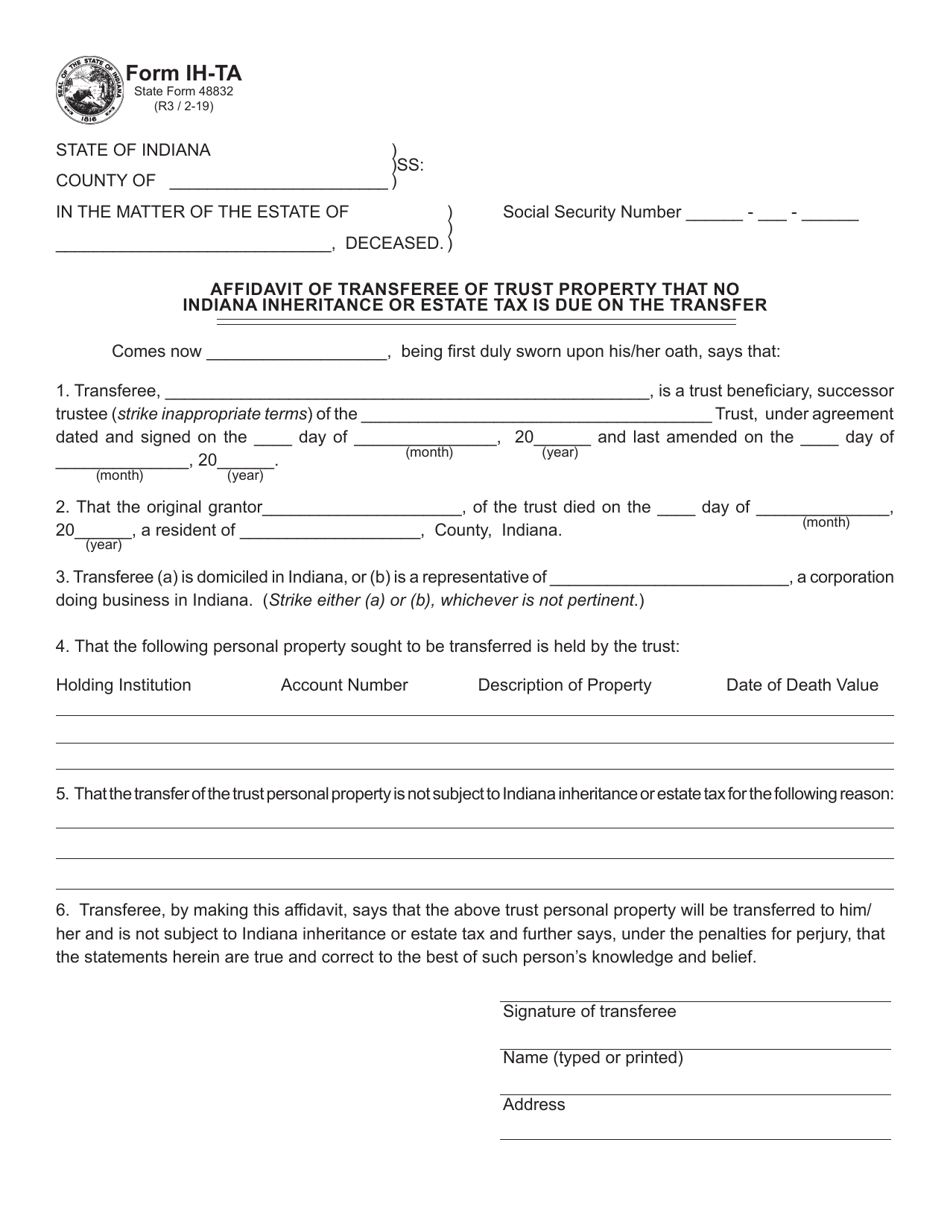

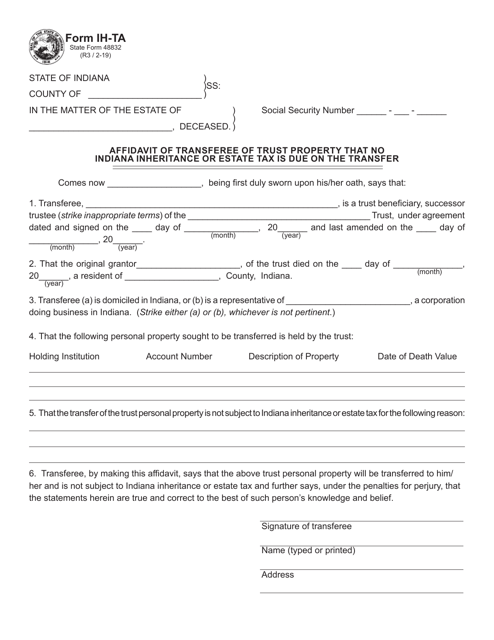

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

Inheritance Tax Waiver Indiana Iae News Site

Indiana Estate Tax Everything You Need To Know Smartasset

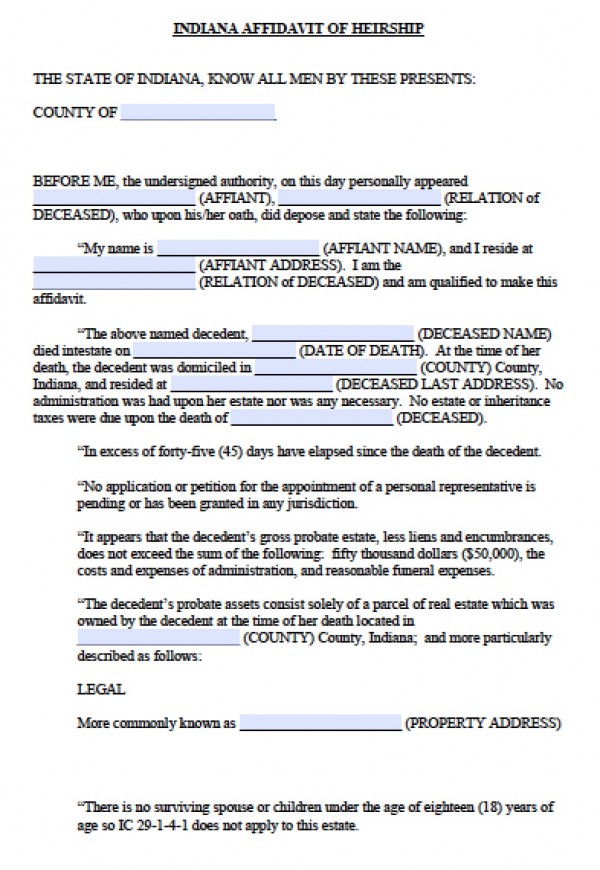

Free Indiana Affidavit Of Heirship Form Pdf Word

State Form 48839 Ih 14 Download Fillable Pdf Or Fill Online Application For Consent To Transfer Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

Fillable Online Ih 6 Not For Public Access Indiana Inheritance Tax Return Fax Email Print Pdffiller

State Form 48831 Ih Exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Nj Form It R Fill Online Printable Fillable Blank Pdffiller

Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Intestate Succession Indiana Us Legal Forms

State Form 48831 Ih Exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

States With An Inheritance Tax Recently Updated For 2020

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller